Smoothcoins: taming crypto volatility for broader adoption

using simple quant techniques (difficulty: **)

TLDR / summary:

A simple construct such as the volatility control mechanism provides an attractive new approach to investing in crypto that does not distort your portfolio risk, yet maintains the diversification crypto was meant to bring. It is not mainstream yet as banks aren’t involved in the ecosystem and no-one else really has a good credit alternative. I highlight a possible implementation. I can provide a more personalized one — just DM me.

The “5% allocation” problem

For a TradFi institutional investor, volatility of cryptocurrencies is a large impediment to adoption – a 5% of crypto allocation translates into a 20% equity allocation on a risk-adjusted basis (BTC is roughly 4 times more volatile than S&P 500).

For a retail investor, having 80% volatility on your crypto portfolio in a bull market feels ok; the same thing on the way down is nerve racking and leads to irrational portfolio adjustments (reducing risk too late and too much for example).

Solution: The Smoothcoin construct

Own an alternate coin delivering a systematic control of crypto volatility.

This can be an explicit control of volatility (leverage / deleverage mechanism based on realized volatility of the asset — this is the topic of this article), or a statistical control of volatility based on momentum (more articles to follow).

The idea is to provide a smart and dynamic mix between long exposure to the crypto markets and passive yield generation. The more volatile the market is the more the strategy will allocate into crypto money markets (or just cash) and vice-versa.

I leverage some of the research honed over the past 15 years in traditional markets to define our base allocation mechanism. I tweak the construct to take advantage of crypto-native primitives such as staking and lending to optimize the performance and capital efficiency.

I think of this product as a true crypto hybrid investment that presents a unique risk profile that democratizes the access to most corners of the crypto ecosystem in a single construct.

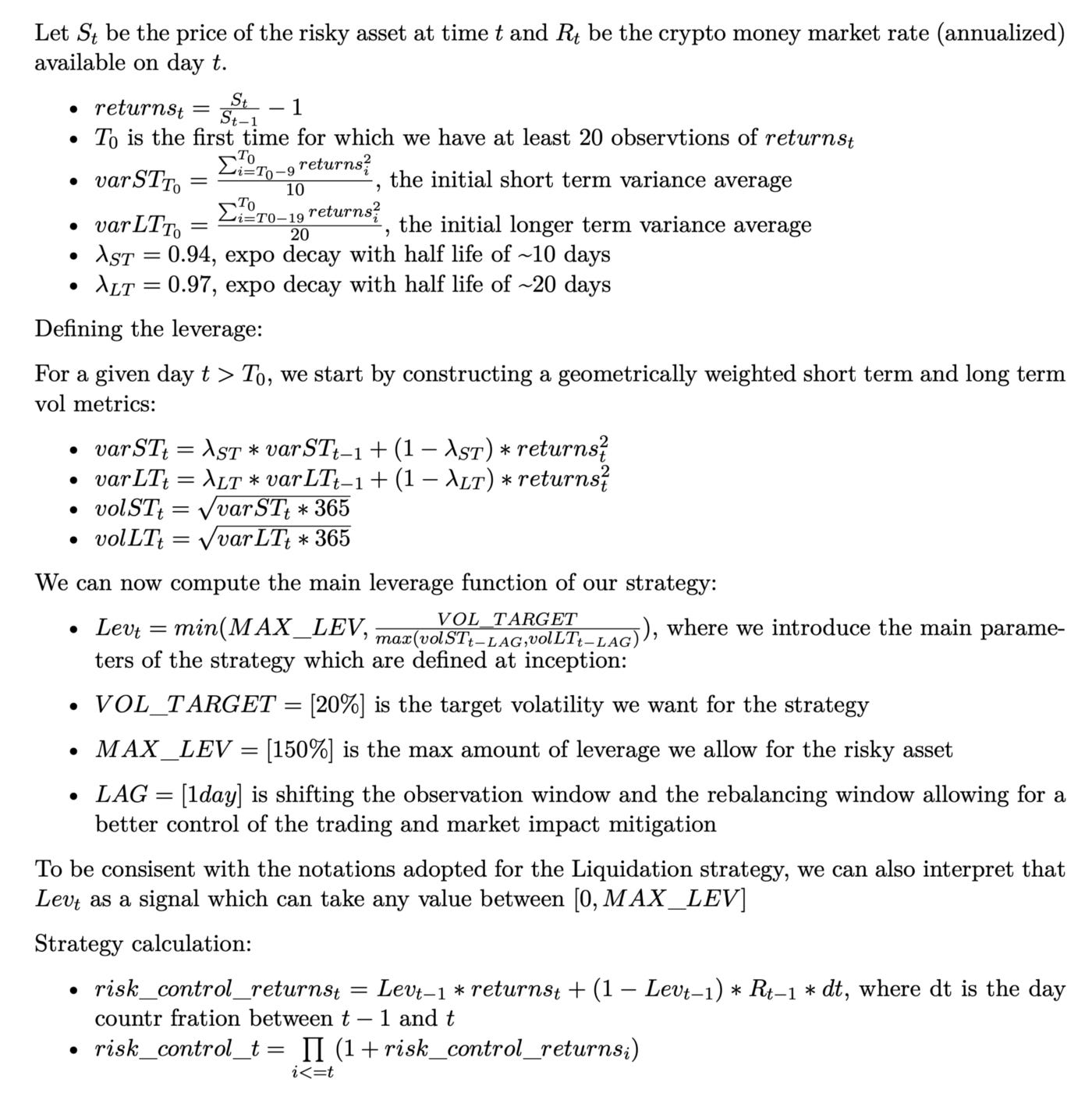

Formal rules and pseudo code

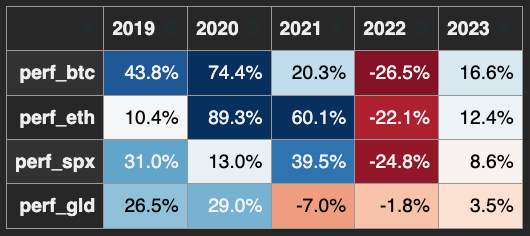

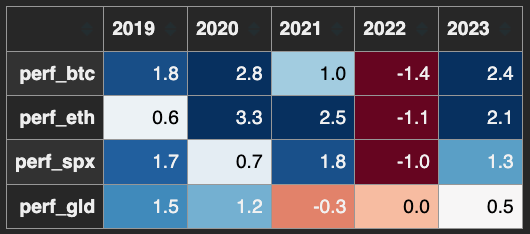

Historical performance and comparison with TradFi benchmarks

You can get a decent return profile while maintaining the allocation vol budget controlled. This is in my view the better way to incorporate crypto within a diversified portfolio as volatility remains elevated for years to come.

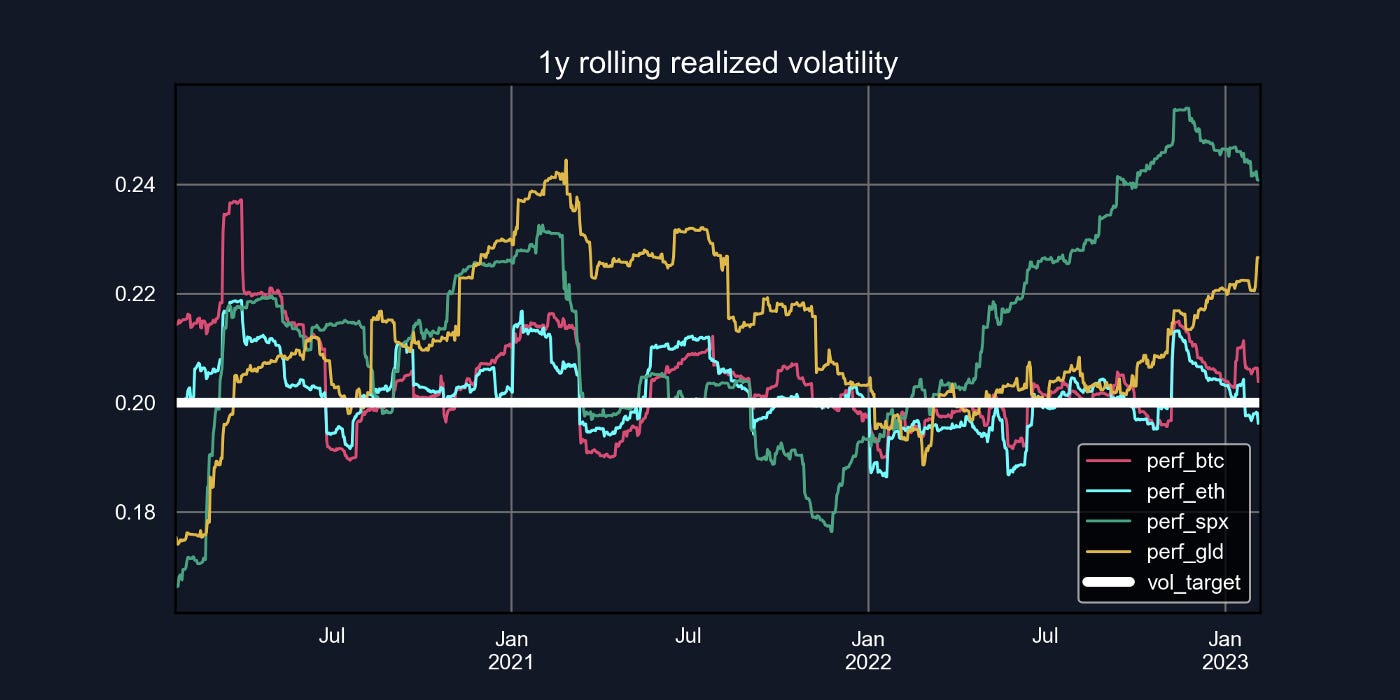

The construction works: the strategy keeps the volatility “controlled” around the target (20% for the sake of this article).

The picture below reflects the dynamic allocation through time.

TradFi implementation

There are several tradeoffs between scalability and compliance I want to highlight.

The crypto trading should take place on CEXs which are strongly compliant.

An extreme case of the strategy could trade CME futures but would suffer a performance bleed of a few % each year. For example:

assuming 10% annualized contango for ETH

20% allocation on average (Lev_t in the section above),

that means a ~2% drag for being perfectly compliant

There is a further drag hidden on rebalance costs since CME futures are far from being the most liquid (that market impact is size dependent and not the topic of this analysis but happy to answer questions on it).

The best implementation will explicit rebalancings, market impact, the trading venues, the custodian, etc.

If credit risk was not an issue, explicit rules could be created (QIS rulebook) and investors would get exposed in a swap referencing the Smoothcoin.

I expect that banks will offer such products in a few years. In the meantime, different implementations will take place and each are suboptimal (e.g managed account hides the market impact and real hedging cost, swaps require credit exposure with entities who hardly have any balance sheet, computation needs to be professionally done and verified,…).

Nevertheless, even a suboptimal implementation of this strategy is better than naked crypto exposure for most investors.

DeFi implementation

One can easily imagine the following smart contract design in DeFi:

Deposit stablecoins in a strategy vault for your desired asset and receive your sToken (“strategy Token”)

The sToken value reflects the compounded performance of the vault strategy

At a given point in time the vault will hold a mix of the risky asset and stablecoins

A smart contract deploys the assets across staking and lending vetted pools to optimize capital efficiency (control KYC/AML by restricting access or making an instit friendly version for example)

The vault rebalances its mix of assets as per the strategy rules above

When sharp rebalances are triggered the protocol might need to recoup assets. It can get back stablecoins in (almost) real-time. For the staking protocols, it can either use the stTokens as collateral (liquid staking) or go into a liquidity pool to get tokens back if needed. I believe the upside from staking and generating yield is much bigger than the friction cost linked to retrieving assets. This methodology will evolve and be fine-tuned but I strongly think this is the best approach to maximize the strategy returns

In other words, you deposit money, you earn an income proportional to the leveraged performance of your desired asset + some passive income + some staking income. On top of that, the volatility of your portfolio will be controlled as you desire…

Conclusion

This construct will pick-up. It exemplifies how QIS strategies can improve the current offering in a transparent and simple manner. Implementation is key and matching the compliance requirements needed by investors today can be done. I would like to help promote strategies like this one and enhance the risk/return profiles for all.