Building systematic strategies with listed crypto stocks

Crypto stocks tend to dislocate more than cryptocurrencies

TLDR/summary:

Coinbase (COIN), Marathon Digital (MARA) and MicroStrategy (MSTR) have become more volatile as they have started gaining traction with institutional investors. Because (a) the relationships between those stocks and the crypto market is not always trivial, (b) analyst coverage is dismal and (c) most participants can’t participate in crypto markets, those dislocations create some interesting trade opportunities which can be captured and turnt into systematic strategies.

Contact me if you are interested in learning more about the strategies (I don’t explicit the rules below; I offer consulting services on trading and implementation).

A strange volatility paradigm

If I were to ask you which one is the more volatile out of Ethereum and COIN, what would you answer?

What about Bitcoin and MARA or Bitcoin and MSTR?

I would have guessed that the crypto component would be more volatile except for MARA. My somewhat simplistic logic would be the following:

COIN should benefit from more volatility and capture more revenues with more trading. True, its staking business has become a significant part of the expected revenues but the dominant effect should still be the exchange part. The transition from higher trading volumes to lower ones (crypto winter) has already occurred so there should be less volatility to the exchange revenues in the current environment.

MARA has mostly fixed costs (a good chunk of the Asics mining chips have been paid for already — the remaining part gets delivered at a floating price, linked to the network activity/demand — which has went down over the past year, the electricity cost is somewhat stable within a range — though it has been ebbing on the more expensive part of the range), it had been waiting for hardware (racks) to deploy a chunk of its unused chips and that has improved. As Bitcoin declined close to the marginal cost of production (~14–15k), miners profits dwindled and they had to sell some of their BTC reserves (at low prices) to cover for their operations. Some miners went down in that process and the survivors got some cheap chips at a discount. From an expected revenue standpoint, surviving miners could have went to 0 or were poised to reap the benefits of a rebound with less competitors in the fray. On top of that, over the recent past, ordinals have been swamping the BTC network, which has led to higher than expected profits from miners (from transaction costs as opposed to mining). I would have expected MARA to have a more convex and volatile profile than BTC.

MSTR now owns 140k BTC which accounts for most of its market cap. It has had steady revenues from its software business of ~500mio per year (over the past 4 yrs) and EBITDA in the [0–80mio] range. Roughly speaking it seems priced in mainly for its BTC holdings and should be trading accordingly.

Let’s look at those annualized volatilities: crypto stocks are now more volatile than cryptos themselves

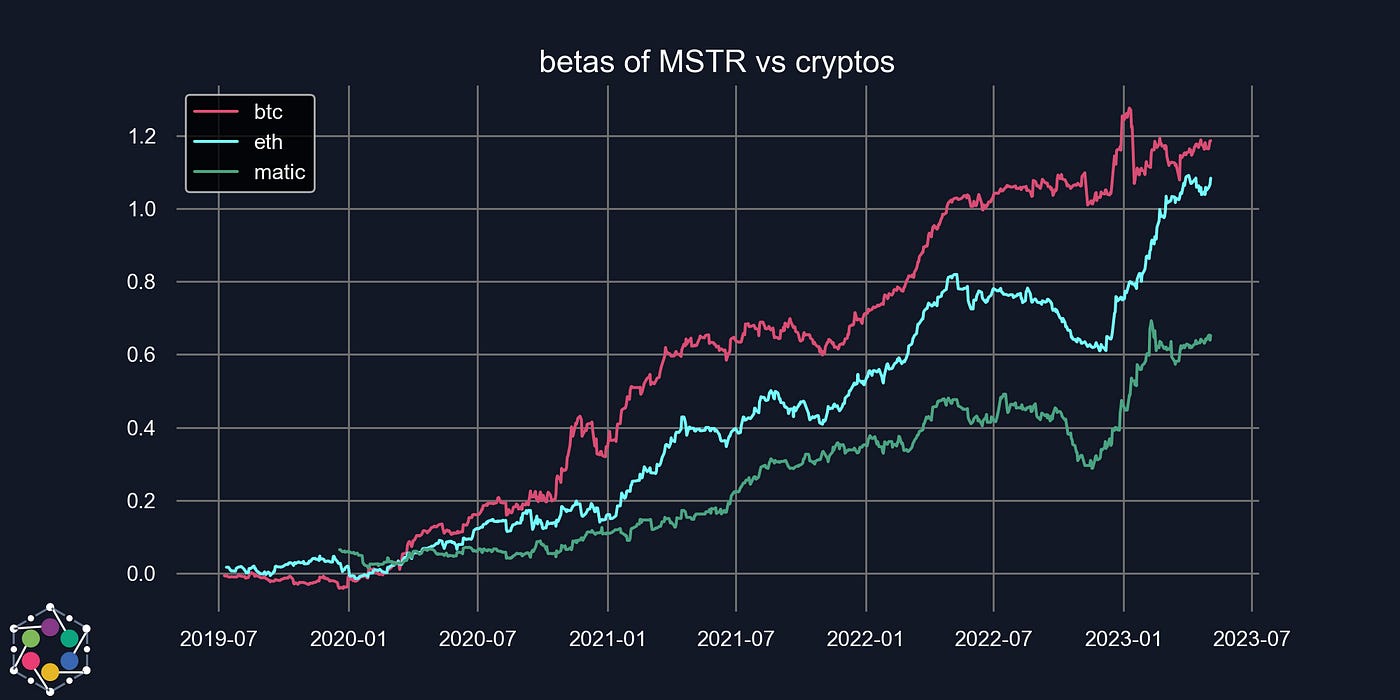

Looking at the beta of each of those crypto stocks versus to cryptos: they have been consistently increasing even before the crypto winter.

Institutional adoption and regulatory arbitrage

As regulatory clarity (at least in the US) has taken longer to emerge, institutional adoption has been a clear disappointment across the crypto ecosystem.

In a nutshell, if you are concerned about your reputation today those are the only instruments you will touch:

CME futures / options (forget about Deribit). Keep in mind that taking a position through futures that you end up rolling has a negative carry (if the curve is in contango).

Grayscale — but in the wake of the DCG turmoil it has become more of a risk to trade those so institutions are rather shunning discounted GBTC — and smaller ETPs/ closed funds. The convergence thesis (conversion to ETF) is a legal gamble and the cost of arbing that position is rather expensive (if the BTC curve trade in contango with 10% p/a you end up paying 10% p/a to keep the position).

Crypto listed stocks

Synthetic exposure to crypto is emerging but most players are careful about their counterparts trading practices and that remains a niche business

Private markets (Ontario Teachers did not enjoy its FTX investment)

It seems to me that crypto stocks are one of the better options to express a crypto view without taking a reputation hit. I believe that as scrutiny has tightened and as the SEC has been more threatening, more players have used those express crypto views.

Volume analysis

For this analysis, I express the daily traded volume of each stock as a fraction of its market cap (the volumes in 2018 were very different than those today). I could have taken another normalization but this should be good enough first order.

First I look at how those volume profiles evolve as bitcoin moves (looking at 4pm returns of Bitcoin). The color represents time (in days vs today). White colors for the recent past and deep blue colors for older regimes.

What I observe is that over the recent past a much larger share of the market cap is being traded across each of those stocks. This seems especially true when crypto is moving more. This observation seems consistent with a broader institutional adoption (though not conclusive on its own).

Short interest profile

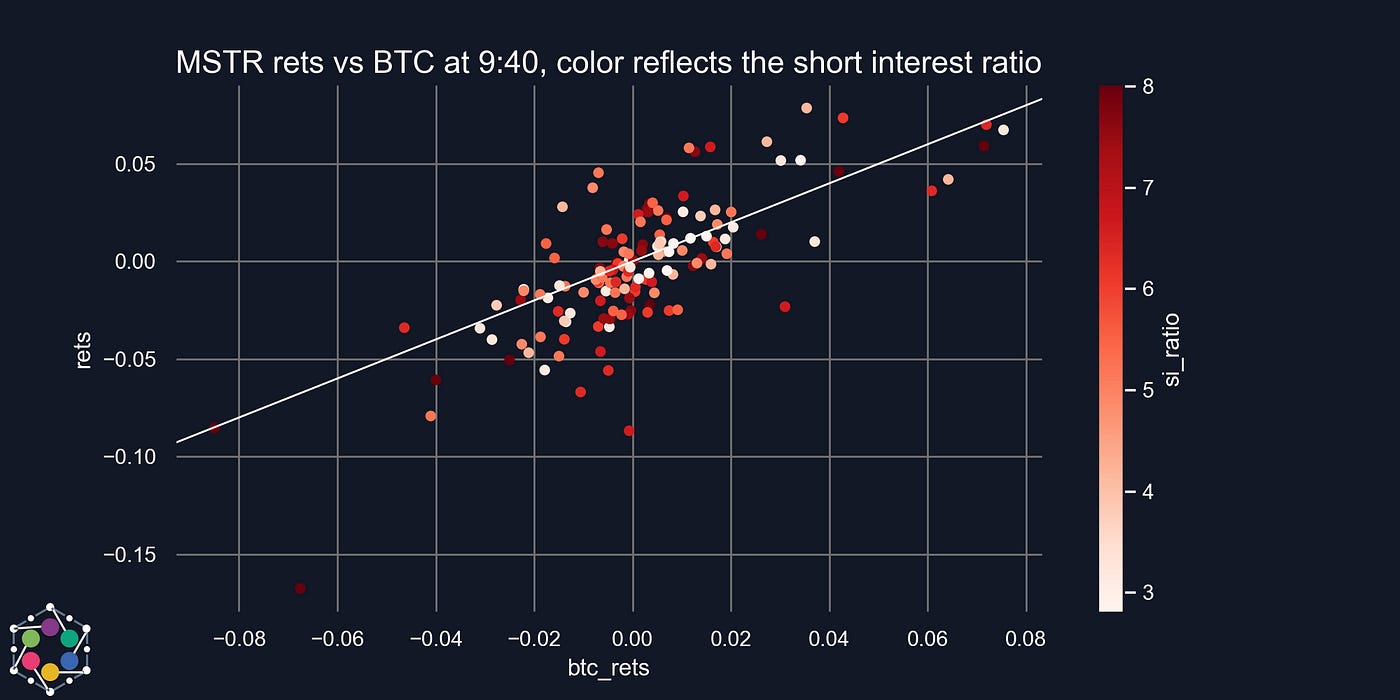

I like to look at the short interest ratio (or cover ratio in this example — expressed in the number of days needed for a short position to be closed, assuming average daily volumes of trading). So a short interest ratio of 4 means that short sellers would need ~4 days of volume to exit their position.

Over the recent past, those ratios have increasing in magnitude which could also reflect that more sophisticated investors are getting into the space. The MSTR one is particularly interesting since it is a cleaner BTC play than the others.

Market distorsions and systematic trading

A much deeper analysis needs to be done to really grasp the extent of institutional adoption (evolution of 13F filings could be a natural next step).

I like to understand why certain dislocations take place before attempting to find a strategy to capture them. The above is a quick attempt to do that.

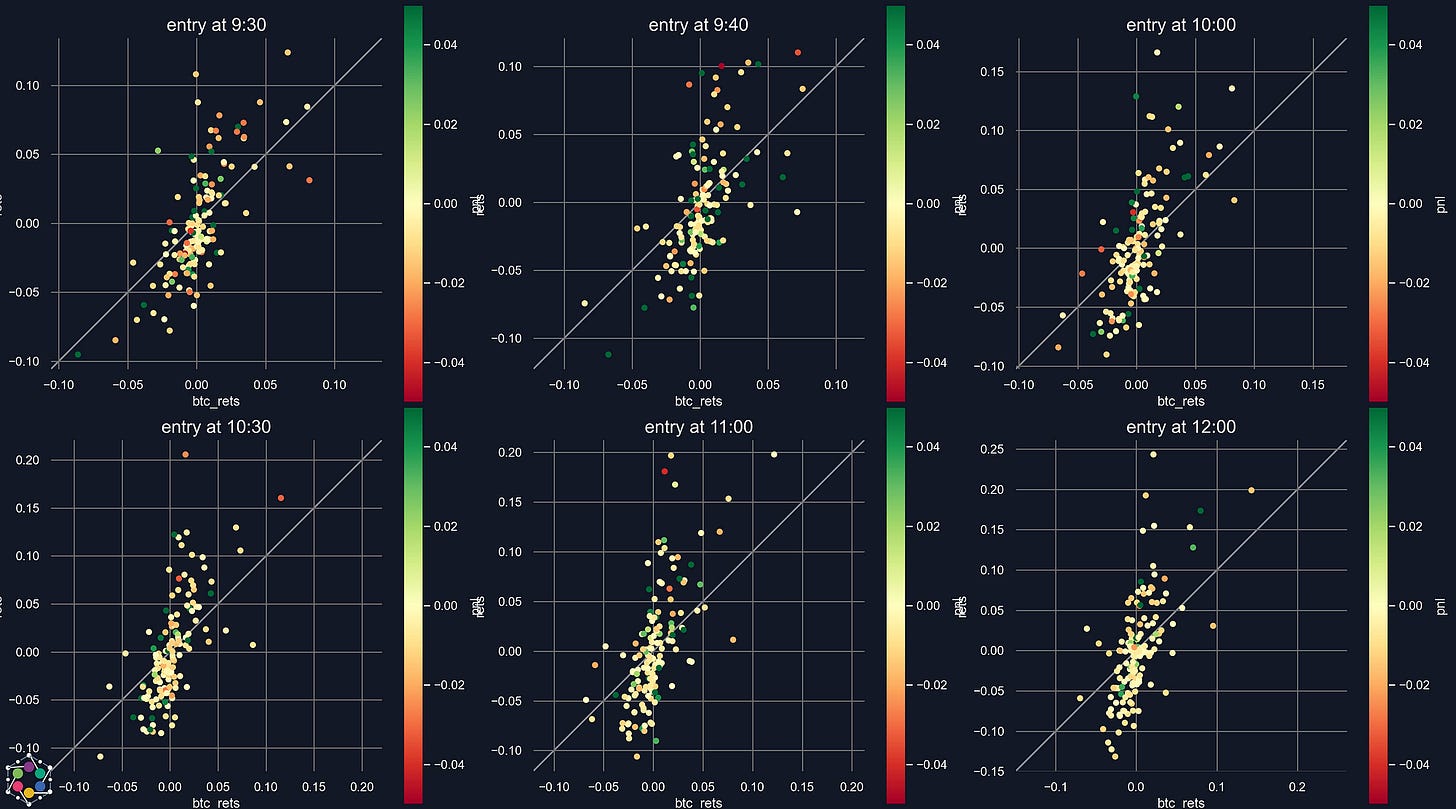

Crypto stocks tend to open more distorted than expected when cryptos move overnight

MARA and MSTR tend to underperform when BTC is down around the open

Across the stocks, largest deviations tend to occurs in regimes of high SI ratio

COIN is more balanced around the open

For very large moves this is less relevant (earnings for stocks and extreme crypto moves). I discard those for the strategy below.

Systematic strategy based on the above

I only have the last 6 months of intraday data for stocks. (Feel free to send me more!).

I have been trading this PA for a while and returns are in line.

This strategy is highly scalable, has 0 reputation risk and can be fully automatized.

For the 3 strategy graphs below, the y-axis shows the PnL of the strategy expressed in % of notional invested. So 0.4 means the strategy returned 40%. This view is not compounding returns. Each day trades with the same notional.

Conclusion

I believe that the regulatory mess we are in creates opportunities which can be captured without taking the idiosyncratic risk (and negative carry) that GBTC vs CME futs offers institutional investors.

I like to put empirical facts into context, even though at times it can lead to detrimental causation biases. I am doing more research on this specific topic today and would love to hear your thoughts.

If you would like to invest into similar strategies, please reach out to me.